Fractional Guide

A Legal Guide To Purchasing Fractional

This article is written by a lawyer with over 25 years experience in the real estate and fractional industry. It guides consumers on the things to consider and questions to ask when purchasing a fractional home or private residence club.

I. Introduction

Fractional have transformed the vacation ownership industry over recent years and are emerging as preferred alternatives to wholly-owned vacation homes. Fractionals attract consumers who can afford luxurious vacation homes but can’t justify the cost and inconvenience of whole ownership when their use of the property is usually limited to only several weeks per year. Consumers are also drawn to the extensive amenities, five-star hotel-like services, high-quality furnishings and finishes, desirable locations, exclusivity, and maintenance-free lifestyle offered by fractional projects.

While fractionals offer vacation home benefits at a fraction of the cost of owning an entire vacation home, the decision to purchase a fractional is significant. Fractional prices range from under $50,000 to several million dollars, depending upon the “size” of the fractional and the related accommodations, the location of the resort, and the degree of luxury provided. Consequently, your purchase of a fractional could prove to be a costly mistake unless you have sufficient information regarding a particular fractional project and ask the right questions of developers, salespersons, and yourself. This brief guide provides you with some of the basic in-formation that you will need in order to avoid the most common pitfalls and turn your purchase of a fractional into a successful, cost-effective, and worry-free venture.

II. The Basics

A. Ownership Structure

A fractional purchaser typically receives an undivided percentage interest in fee simple in an individual residential accommodation and the related common areas of the applicable resort or other property, affording the purchaser the right to occupy such accommodation or one of similar size and type and use the property’s amenities for a certain number of days or weeks each year. A fractional accommodation is most often a condominium unit but can also be a townhome, detached single family home, or hotel suite. Some fractional projects participate in an exchange program, whereby purchasers have access to other properties of comparable quality located throughout the United States and abroad.

B. Purchase Price; Assessments and Dues

Fractional purchasers pay a one-time purchase price and yearly assessments that cover the expenses of operating and maintaining the fractional project. In some fractional projects, separate fees may be assessed for the use of certain amenities.

C. Financing

Although financing for the purchase of a deeded fractional interest isn’t nearly as prevalent as it is for the purchase of “whole” vacation homes, more and more lenders are treating the two purchases similarly for financing purposes. Many fractional purchasers tap a home equity line to finance their purchases or resort to other independent financing means.

D. Resales

You should only purchase your fractional for personal use, without any expectation of rental returns, appreciation, or other financial benefits. You can resell your fractional just like you can sell a wholly-owned vacation home. Before purchasing a fractional, however, you should confirm that subsequent purchasers of your fractional would have the same use rights and privileges that you would have as the original purchaser. You should also determine the amount of any transfer fee, if any, that you or your purchaser must pay. In addition, the slowing real estate market and market saturation in certain locations may affect the resale potential of your fractional.

E. Accommodations

Fractional accommodations, usually condominium units, typically contain one to four bedrooms and are frequently equipped with high-end furniture and finishes.

F. Rentals

Fractional purchasers may or may not have the opportunity to rent their reserved accommodations. However, due to existing federal and state securities laws, the developer may be restricted in the specific information that it can discuss with you regarding an available rental program. You should consult with the rental program representatives, if any, for more details regarding the ability to rent your reserved accommodation.

III. During the Sales Process: Asking the Right Questions of Developers, Salespersons, and Yourself

Being well-informed is critical to the purchasing decision. The answers to the questions below should provide you with enough information to be able to make a sound decision regarding the purchase of a fractional. However, by no means is this list of questions below meant to be exhaustive. You should ask as many questions as you deem necessary in order to feel comfortable with your purchasing decision.

A. Development and Management

The developers of fractional projects range from individual entrepreneurs, to established resort developers, to large, international hospitality companies such as Four Seasons, Ritz Carlton, and Hyatt. “Brand” developers bring credibility, exposure, greater marketing and sales resources, and the proven ability to deliver luxury hotel-like services and amenities. However, larger developers are often less flexible than smaller developers. In addition, some purchasers prefer smaller, unbranded projects, believing that they provide a more intimate vacation ownership experience. Finally, a consumer usually pays a premium for the enhanced credibility and reputation of a “brand” developer.

Before purchasing a fractional, you should ask :

- What is the background and experience of the developer?

- Has the developer been involved with similar projects?

- How familiar is the developer with the geographic area(s) in which the project is located?

- With what management, exchange, and hospitality companies is the developer associated?

- With what management, exchange, and hospitality companies is the developer associated ?

You should also familiarize yourself with the management company that has been engaged by the developer to operate, maintain, and manage the fractional resort;

B. Ownership Structure

Before purchasing a fraction, you should ask:

- Will I receive a recorded deed and title insurance?

- How many days of use am I guaranteed each year? Each season? For example, different developers define fractionals in different ways. A 1/8 interest may mean six weeks (42 days) at one resort and five weeks (35 days) plus additional space-available usage, at another resort.

C. Use Rights

Before purchasing a fractional, you should ask:

- How does the reservation system work?

- How is occupancy of the accommodations allocated between owners?

- By what means, if at all, will I have the opportunity to reserve an accommodation for one or more high demand periods each year (e.g., Christmas, New Years, etc.)?

- Are owners allowed to reserve accommodations on a space-available or “bonus” basis?

- What was the previous year’s occupancy rate for the project/club?

- What is the check-in/check-out process?

- Can family members/guests use the accommodations without the owner? If so, immediate family members only? What age must they be?

- Do I have use rights in a particular unit or in a particular unit type? If my use rights are “floating” among a particular unit type, what options do I have to reserve a particular unit, if any?

- Is the fractional project affiliated with an exchange program?

- If so, is exchange program participation mandatory or voluntary?

- What other resorts are included in the exchange program?

- What fees must I pay to participate in the exchange program?

D. Resort Accommodations; Amenities and Services

Before purchase a fractional, you should ask:

- How are the accommodations furnished (style, quality, etc.)?

- How are the furnishings maintained (repair, frequency of replacement, adequacy of reserves, etc.)?

- Who owns the project’s/club’s amenities? By whom and under what circumstances are the amenities subject to change?

- Do non-owners have use rights in the amenities?

- What services are available to owners (concierge, valet, transportation services, housekeeping, welcome packages, hospitality toiletries, etc.)?

- What is the frequency of housekeeping during an owner’s stay? Can I pay for more frequent housekeeping services?

- What is the average size of the unit or unit type in which I will have use rights (square footage, number of bedrooms and bathrooms, etc.)?

- do the accommodations have a “lock-off” capability?

E. Purchase Price and Assessments; Deposits and Annual Dues; Assurances

Before purchase a fraction, you should ask:

- What is the purchase price of the fractional and for what closing costs will I be responsible?

- Is financing available from the developer? If so, what are the terms?

- Are there any escrow arrangements or other financial assurances with respect to my earnest money deposit?

- What is the estimated annual maintenance fee? What does it cover?

- Are here any fees, in additional to the annual maintenance fee, for the use of any of the amenities or services at the fractional project?

- Is there a cap on periodic increases in the annual maintenance fee?

F. Resale; Transfer

Before purchase a fractional. you should ask:

- Are there any restrictions or fees associated with the resale of my fractional? Does the developer have a right of first refusal?

- Does a subsequent purchaser have the same rights and privileges as the original purchaser of the fractional?

IV. Useful Tips For Purchasing Your Fractional

- Choose the vacation ownership product that most closely matches your lifestyle and your and your family’s present and anticipated future needs.

- Physically inspect the fractional project, if possible. While there, talk to existing owners about their experiences.

- Read all of the fractional documents very carefully. If you do not understand a particular provision, make sure that you ask the salesperson for a clear explanation.

- Engage an experienced attorney to assist you in reviewing the fractional documents and completing your purchase. The vacation ownership industry is heavily regulated, and determining which consumer protection laws apply to a particular fractional project is complicated. An experienced attorney can help you to determine whether the developer has complied with all applicable state and federal laws, ensure that you have been provided with all of the documents to which you are legally entitled, and notify you of any cancellation rights that you have.

- The form and content of your purchase contract is most likely not negotiable. Many of its provisions may be prescribed by state and federal law. Purchase contracts often contain a description of: (i) the fractional that you are purchasing; (ii) the purchase terms, including purchase price and closing costs; (iii) acceptable payment methods; (iv) your cancellation right, if applicable; (v) any escrow arrangements and/or financial assurances to protect your deposit, if applicable; (vi) any rights reserved by the developer; (vii) annual assessments and/or dues; (viii) the developer’s and buyer’s default remedies; and (ix) the developer’s warranties and disclaimers.

- Do not rely on any oral representations made to you during the sales process. Only statements in writing should be relied upon.

Good luck with your fractional purchase!

The author, Mel S. Weinberger, is a partner in the Washington DC office of Holland & Knight LLP.

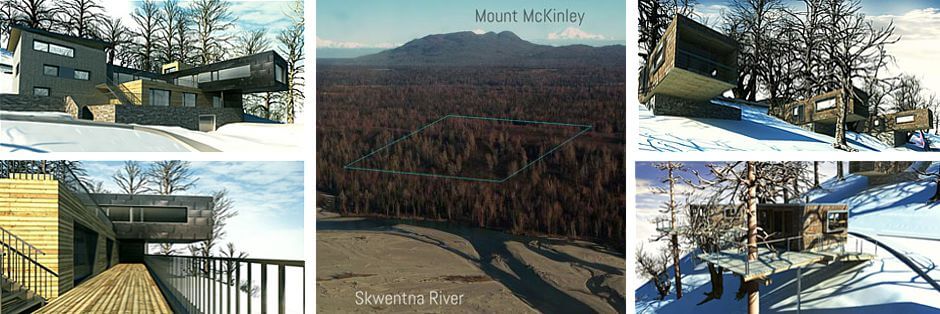

Alaska Development Plan

The positioning of Mat-Su Valley is in the heart of Southcentral Alaska possesses a lot more than 23,000 square kilometers of hilly unspoiled character green pastures with breathtaking wildlife, glaciers, lakes, rivers, and will be offering ideal conditions for the creation of a adventure resort project for vacationer, offerings lodging, vacation homes and services in the World Best Wilderness.